In today’s digital age, ensuring that your financial records are in order is not just a matter of responsibility; it’s a necessity. One critical aspect of this financial alignment is Aadhar Card PAN Card link, streamlining your transactions and ensuring compliance with regulatory requirements.

The Significance of Linking Aadhar and PAN

Enhanced Financial Transparency

Linking your Aadhar Card with your PAN Card facilitates enhanced financial transparency. This linkage ensures that all your financial transactions are seamlessly tracked and monitored, contributing to a more transparent financial ecosystem.

Streamlined Tax Filings

Aadhar-PAN linking simplifies the tax filing process. With both cards linked, you can easily file your income tax returns online, reducing the paperwork and minimizing the chances of errors.

Government Initiatives and Compliance

The government has been actively encouraging citizens to link their Aadhar and PAN for various initiatives. From subsidy disbursement to ensuring a more robust taxation system, this linkage plays a pivotal role in government initiatives.

Read Also: JEE Mains Admit Card Download: Your Comprehensive Guide | Clear Update

How to Link Aadhar Card with PAN Card – A Step-by-Step Guide

Step 1: Verify Details

Before initiating the process, it’s crucial to verify the details on both your Aadhar and PAN Cards. Ensure that the information matches accurately to avoid any discrepancies during the linking process.

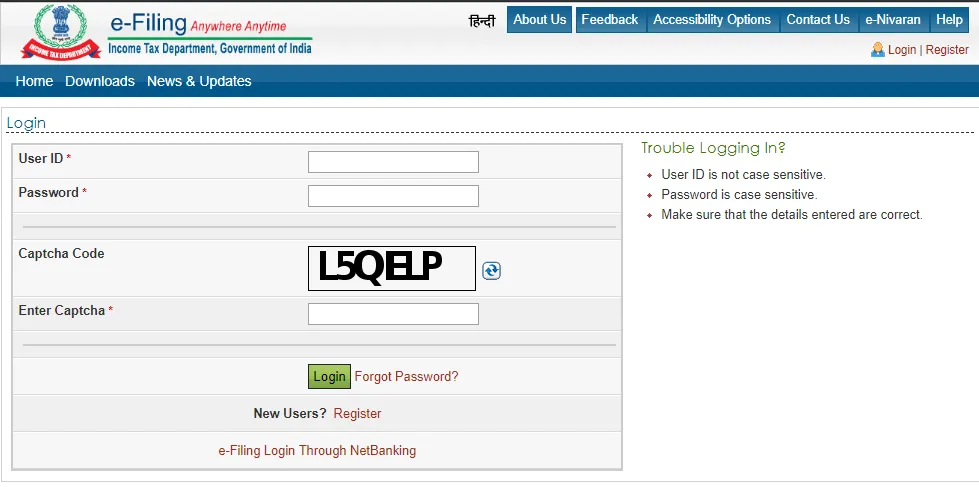

Step 2: Online Portal Access

Access the official Income Tax Department’s online portal. Navigate to the ‘Link Aadhar’ section, where you will be prompted to enter your PAN, Aadhar number, and other required details.

Step 3: OTP Verification

Upon entering the necessary information, an OTP (One-Time Password) will be sent to the mobile number linked with your Aadhar. Enter the OTP to proceed with the verification process.

Read Also: Pradhan Mantri Suryoday Yojana: Know what it is | Clear Update

Step 4: Successful Linking Confirmation

After successful verification, a confirmation message will be displayed, indicating the successful linking of your Aadhar Card with your PAN Card.

(FAQs)

Is Aadhar-PAN Linking Mandatory?

Yes, as per the current regulations, linking your Aadhar Card with your PAN Card is mandatory.

What Happens if I Don’t Link Aadhar and PAN?

Failure to link Aadhar and PAN may result in your income tax return being considered invalid, leading to potential legal consequences.

Can I Link Aadhar and PAN Offline?

While the online process is more convenient, you can also link your Aadhar and PAN by visiting designated PAN service centers.

[…] Read Also: How to Aadhar Card PAN Card link | Clear Update […]

[…] Read Also: How to Aadhar Card PAN Card link | Clear Update […]